APPEAL YOUR DENIAL NOW ***

APPEAL YOUR DENIAL NOW ***

Appeal Letter Guides, Tips & Templates

Hospitalized After Cosmetic Surgery?

A patient was hospitalized for over a month after cosmetic surgery—but her insurance appeal still failed. Learn which arguments did not work and how to avoid the same mistakes.

Canceled Health Insurance but Still Billed? Here’s Why

Canceled your health insurance and still got billed for the full month? This real court case explains why it happens, why most appeals fail, and what steps actually help.

Insurance Denied Life-Saving Medication? Why Failing to Appeal Can Cost Everything

When health insurance denies life-saving medication, many people assume they can sue later. This real federal case explains why failing to appeal can permanently shut that door—and what to do instead.

When State Law Requires Coverage but an ERISA Plan Says No: What a 2025 Federal Case Means for Insurance Appeals

A federal court ruled that insurers cannot use ERISA to avoid state-mandated health benefits. Here’s what the BlueCross v. Nicolopoulos case means for fertility treatment coverage, autism therapy, mental health benefits, and other common insurance appeals.

2026 Update — Why Claim Denials Are Up, and What You Can Do About It

Health insurance claim denials are increasing in 2025–2026 due to AI reviews, stricter prior authorization, and administrative errors. Learn why your claim was denied and how to appeal with a strong, attorney-quality letter.

Tips for Appealing Insurance Denials (Attorney-Crafted Guide to Winning Your Health Claim Appeal)

If your health insurance claim was denied, you still have options. This attorney-written guide explains the strongest tips, evidence, and appeal strategies insurers don’t tell you — so you can overturn a wrongful denial and avoid costly mistakes.

What to Do When Your Claim Is Denied With Code CO-109 (Claim Not Covered by This Payer)

A CO-109 denial means the insurer says it isn’t the responsible payer — but that doesn’t always mean they’re right. Learn the real reasons CO-109 happens and how to correct, resubmit, or appeal the denial with supporting documentation.

What Happens If You Don’t Have Health Insurance? And What to Do When You Get a Medical Bill You Can’t Afford (Attorney + Personal Guide)

If you don’t have health insurance — or thought you were covered — a medical bill can feel devastating. This attorney-written guide explains exactly how to dispute charges, appeal denials, and reduce or eliminate what you owe.

What To Do Now If Your Health Insurance Claim Was Denied. Attorney Explains.

If your health insurance claim was denied, don’t panic. An insurance attorney breaks down the exact steps to take next, how to read your denial letter, and how to file a strong appeal to get your claim reconsidered.

What to Do When Your Claim Is Denied With Code CO-96 (Non-Covered Charges)

A CO-96 denial means the insurer considers your service a “non-covered charge.” But many CO-96 denials are incorrect — caused by coding issues, coverage misunderstandings, or insurer mistakes. Here’s how to fix it and appeal effectively.

“My Doctor Said the Procedure Was Covered — Then I Got a Huge Bill.” What Can You Do Next? (Attorney + Personal Guide)

Your doctor said the procedure was covered — but now you’re stuck with a surprise bill. Learn why this happens, how to dispute or appeal it, and how to use attorney-crafted templates to reduce or eliminate what you owe.

What to Do When Your Claim Is Denied With Code CO-197 (Preauthorization Required)

A CO-197 denial means your insurance company believes the service required preauthorization that was not obtained. Many CO-197 denials can be reversed — especially when the insurer misapplied policy rules or when the provider requested auth correctly. Here’s how to fix it and appeal.

What to Do When Your Claim Is Denied with CO-50 (Medical Necessity Denied)

A CO-50 denial means the insurer believes the service was “not medically necessary.” Here’s how to read the denial, gather the right evidence, and file a strong appeal that forces the insurer to reconsider.

What to Do When Your Claim Is Denied With Code CO-167 (Diagnosis/Procedure Mismatch)

A CO-167 denial means the insurer thinks the diagnosis code does not support the procedure billed. This mismatch is often due to coding errors—not actual lack of medical necessity. Here’s how to fix the coding or appeal the denial if the insurer is wrong.

What to Do When Your Claim Is Denied With Code PR-1 (Deductible Not Met)

A PR-1 denial means the insurer says the patient is responsible for the charge because the deductible wasn’t met. But PR-1 denials are often wrong — sometimes caused by insurer miscalculations, incorrect coding, late claim processing, or plan misinterpretations. Here’s how to fix or appeal PR-1.

Free Appeal Template for Medical Claim Denial (Plus a Free Guide to Help You Win Your Appeal)

When your medical claim is denied, you may search for a free appeal template—but what you really need is clear guidance and the right language to overturn the decision. This post explains how to write a powerful appeal, offers a free step-by-step Appeal Guide, and shows you how to access a professional $29 template to maximize your chances of approval.

How to File an External Appeal When Your Health Insurance Claim Is Denied (2025 Guide)

If your health insurance appeal was denied, you still have a powerful right to file an external appeal. This easy-to-follow guide explains how external appeals work, who qualifies, deadlines, and how to give yourself the best chance of overturning your denial.

New State Laws Target Automatic Denials: How This Strengthens Your Right to Appeal

New state laws are cracking down on automated insurance denials—including an Arizona law banning algorithm-driven claim denials by 2026. Learn how these legal changes boost your appeal rights and how to fight a wrongful denial using our FREE Appeal Guide and $29 appeal template.

Out-of-Network Denials: Your Rights + Free Appeal Guide + $29 Template

Out-of-network denials are one of the most common — and most frustrating — reasons health insurance companies refuse to pay legitimate claims. The good news? You have powerful rights under the law, and many of these denials can be overturned with a well-written appeal.

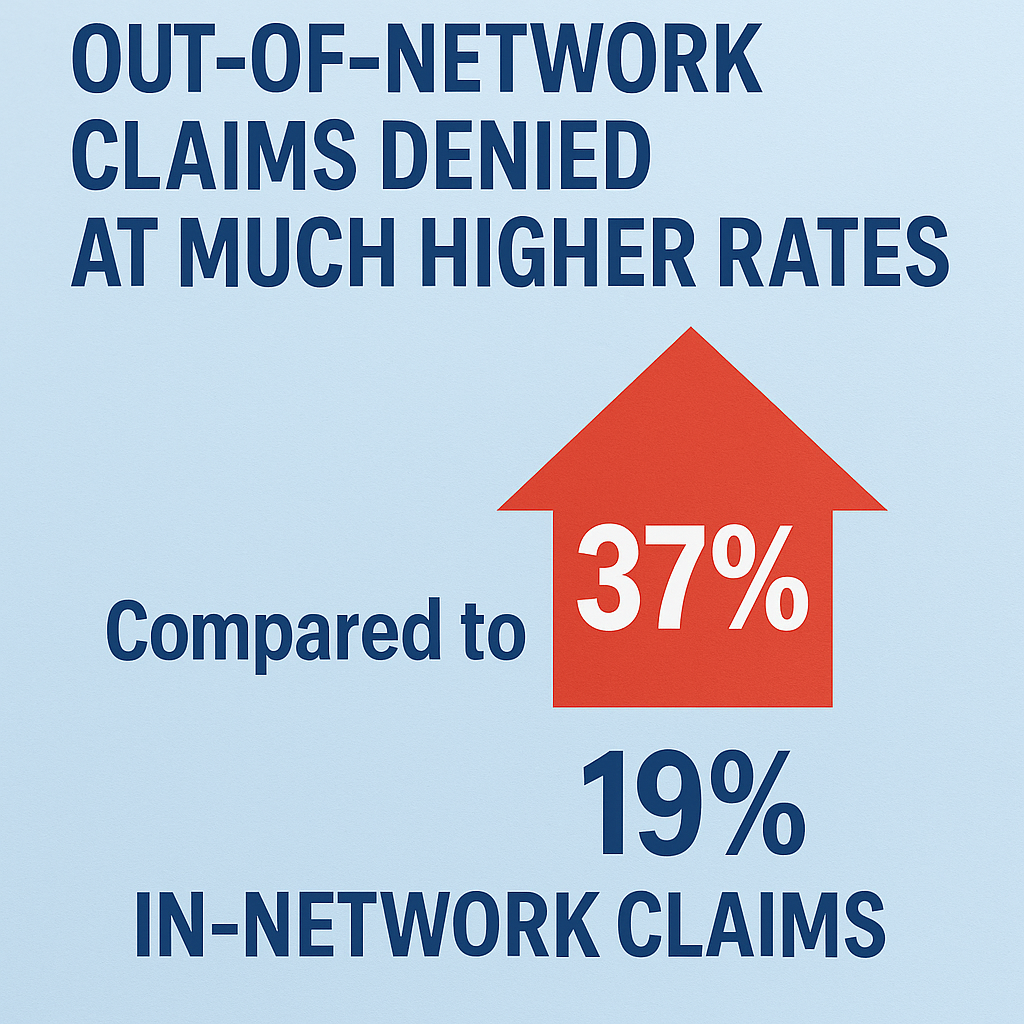

Out-of-Network Claims Denied at Much Higher Rates: What This Means for Your Appeal

KFF reports a 37% out-of-network claim denial rate—compared to just 19% for in-network care. This article explains why out-of-network claims are denied so often and how to use a strong appeal letter, our FREE Appeal Guide, and our $29 template to fight back.